Model Portfolios built for Advisors - Institutional Quality

Access institutional-grade investment process by licensing our model portfolio strategies tailored specifically for independent advisors and solo RIAs, designed for a range of objectives and risk profiles. Our strategies are built within a proprietary five-tier risk framework.

At Alamut Capital, we employ a quantitative investment approach grounded in data-driven insights, systematic research, and disciplined execution. Our strategies are designed not only to align with each risk profile, but also to adapt dynamically to shifts in the macroeconomic environment.

We believe our edge lies in the ability to respond proactively to changing market conditions by managing risk, minimizing downside exposure, and positioning portfolios to capture long-term growth potential.

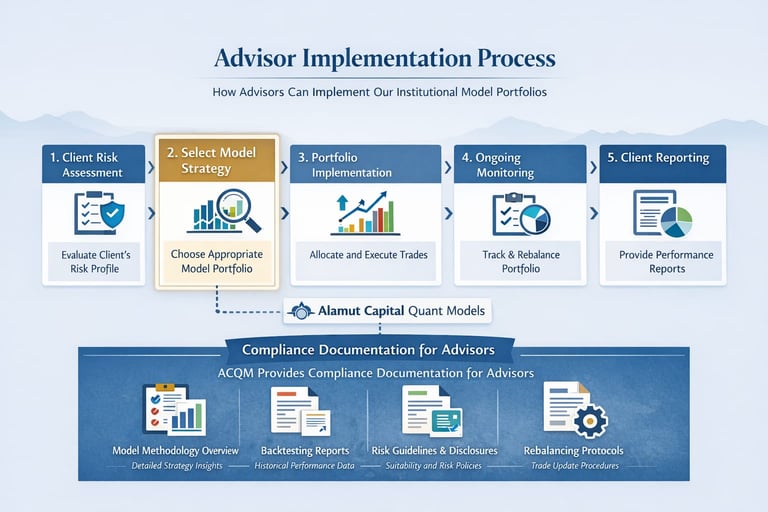

How Advisors use our Models

➡️ Advisors determine individual client's risk profile and map it with our 5 risk profiles.

➡️ Advisors select the most appropriate model or a mix of models from the identified risk profile.

➡️ Advisors receive list of holdings/securities along with their allocation weights within portfolio across all the relevant model strategies.

➡️ Advisors use this information and can then implement the appropriate model strategies in the respective client portfolio accounts.

How are we different?

✅ Institutional Grade quantitative investment process.

✅ Built to respond to changing macro-economic regimes with downside minimization at core of all strategies.

✅ Advisors retain full control of implementation with no restriction on client asset custody.

✅ Advisors retain 100% branding.

✅ No AUM fees dragging Advisor's margins.

Request Our Model Portfolio Strategy profiles

Contact Us

models_solution@acquantmodels.com

© 2026. All rights reserved.

Disclaimer: The model portfolio strategies provided by Alamut Capital Quant Models Inc. are offered solely to registered advisers and are licensed as intellectual property. We do not provide personalized investment advice, portfolio management services, or recommendations to any individual investor.

The information provided is not intended to be and does not constitute financial, legal, tax, or investment advice. Implementation of any model strategy is the sole responsibility of the subscribing advisor or portfolio manager, who must determine its suitability and compliance with their clients’ investment objectives, risk profiles, and regulatory obligations.

Alamut Capital Quant Models Inc. is not registered as an investment adviser in any jurisdiction and does not interact with any investors. The firm does not offer account-level services, make investment decisions on behalf of clients, or assume discretionary authority over assets.

Past performance is not indicative of future results. All investments involve risk, including possible loss of principal. Use of our models does not guarantee any specific outcome or performance.

Alamut Capital Quant Models Inc